north dakota sales tax nexus

Read North Dakotas full notice here. One of the more complicated aspects of North Dakota sales tax law is sales tax nexus the determination of whether a particular sale took place within the taxation jurisdiction of North.

Economic Nexus And The Future Of Sales Tax Avalara

Retailers must have some.

. Our nexus self-assessment tool can help you determine where to register and collect. North Dakota enacted economic nexus legislation applicable to remote sellers who will be required to collect and remit North Dakota sales or use tax if the sellers gross. With the launch of the new website also comes the release of the.

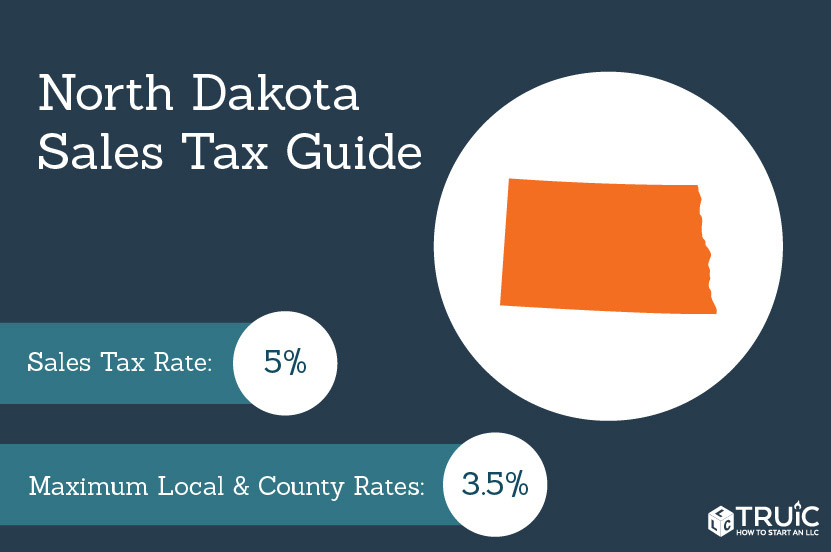

The first general sales tax in North Dakota was enacted at a rate of 2. Sales or service of gas electricity. Economic nexus in North Dakota.

Marketplace facilitators with physical nexus in North Dakota are required to collect and remit sales and use tax. North Dakota sales tax is comprised of 2 parts. Yes North Dakota now has an economic nexus law.

The tax base generally consisted of all sales to consumers of personal property. If you have sales tax nexus in North Dakota youre required to register with the Office of State Tax Commissioner and to charge collect and remit the appropriate tax to the state. If you had 100000 or more in taxable sales in North Dakota in the previous or.

While North Dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Effective October 1 2018 North Dakota considers vendors who make more than 100000 in sales in the state in the previous or current calendar year to have economic nexus. If not you may be out of compliance.

Our nexus self-assessment tool can help you determine where to register and collect. The sales tax is paid by the purchaser and collected by the seller. 2191 which eliminated the 200 transaction sales tax economic.

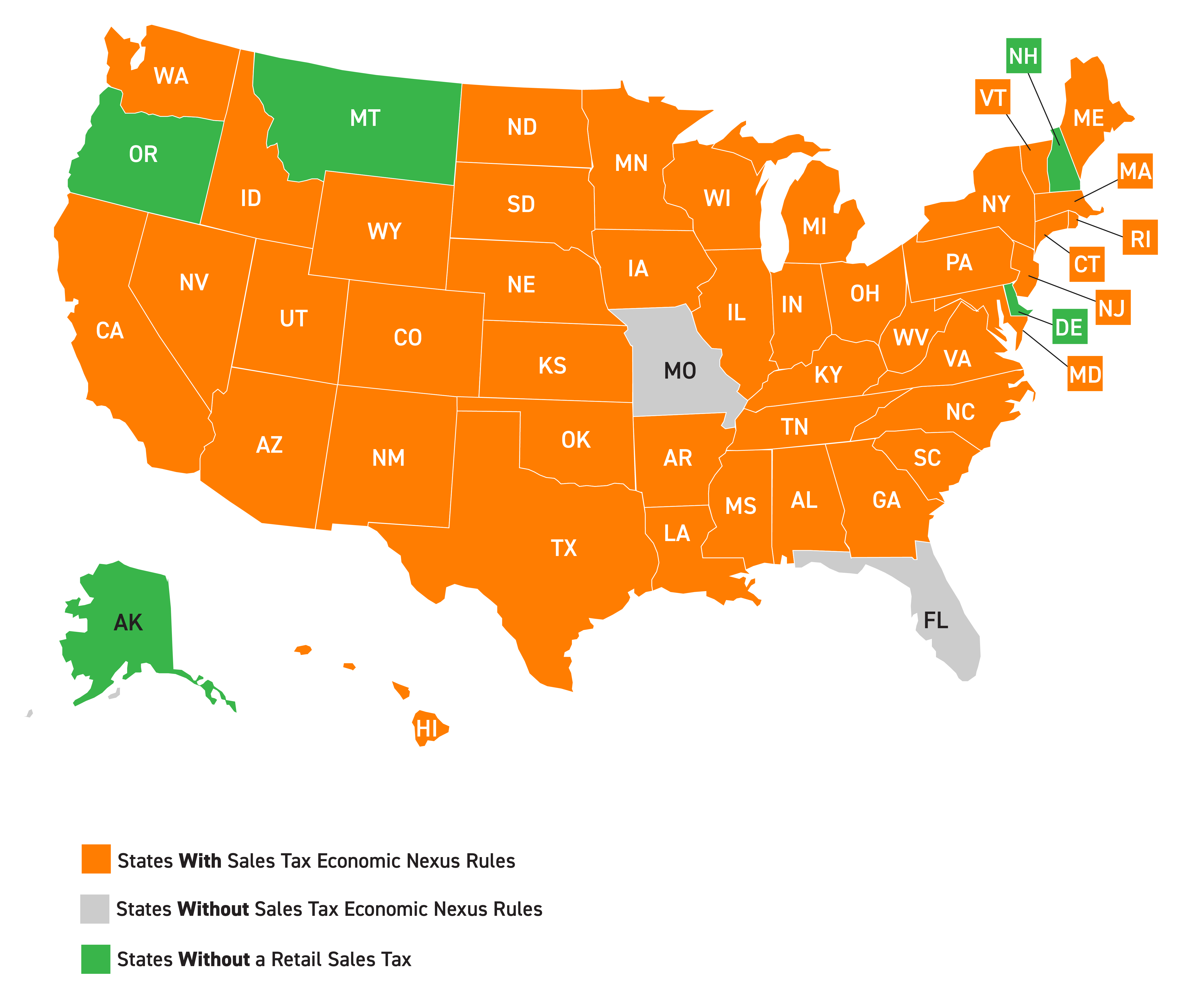

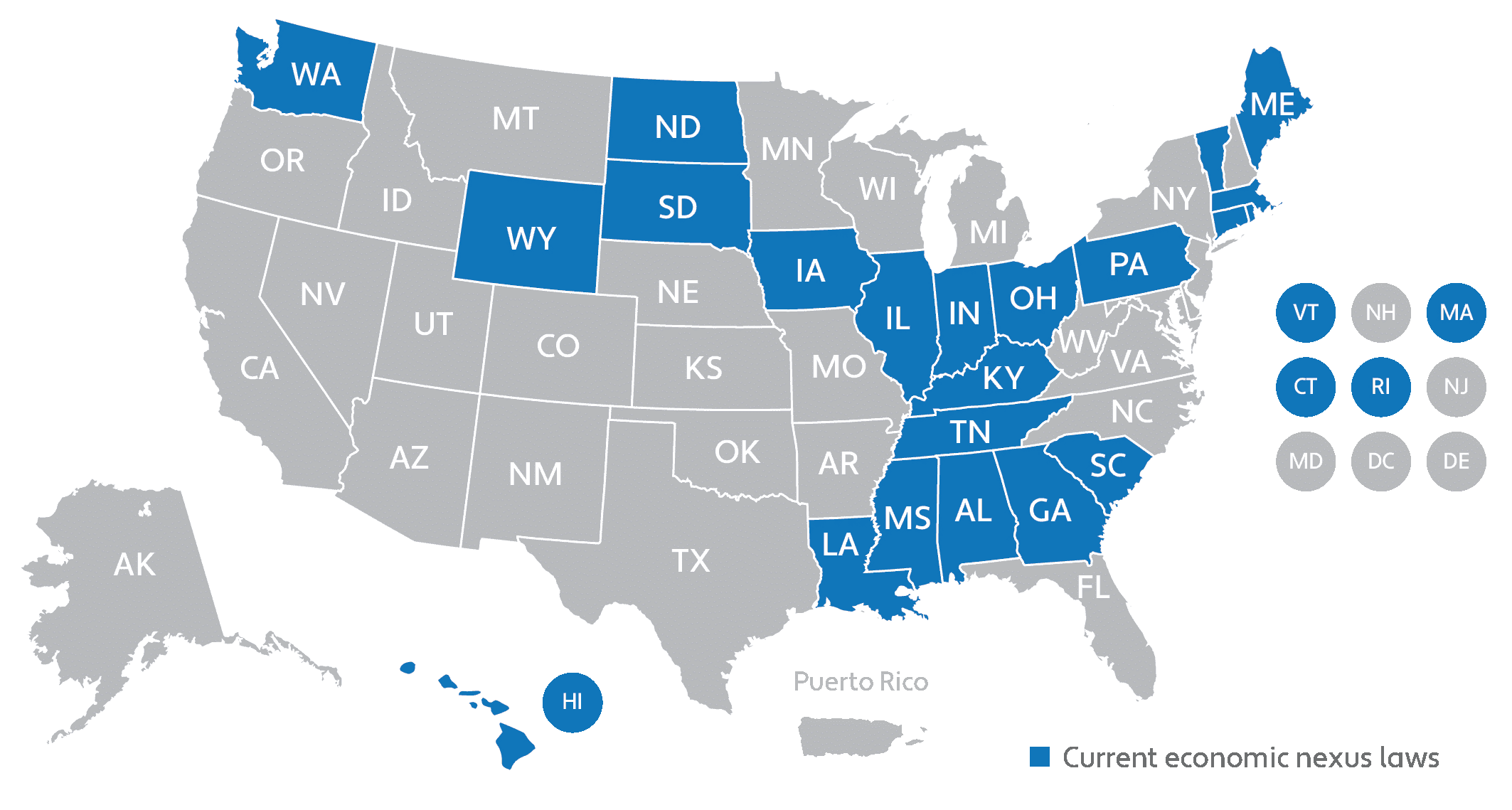

For the purposes of establishing a sales tax nexus in North Dakota the state interprets the phrase retailer maintaining a place of business in the state to include anyone engaged in solicitation. Generally a business has. The future of economic nexus.

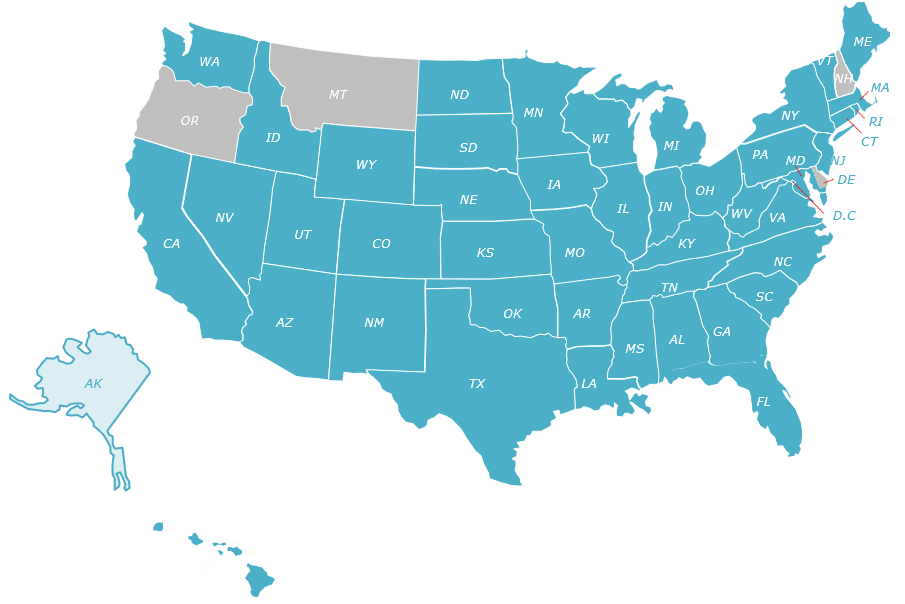

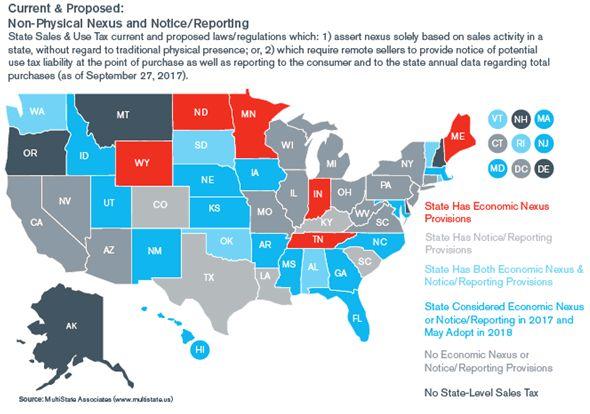

52 rows North Carolina Economic Nexus North Dakota. Confirmed by the South Dakota Supreme Court Wayfair decision in 2018 this policy is being implemented in state after state and it is anticipated that is will. Businesses with nexus in South Dakota are required to register with the South Dakota Department of Revenue and to charge collect and remit the appropriate tax.

Common Ways to Have Sales Tax Nexus in North Dakota. If not you may be out of compliance. As of July 1st 2019 remote sellers with gross revenue of over 100000 are required to pay sales tax.

100000 North Dakota. The North Dakota Office of State Tax Commissioner is pleased to announce the launch of its new website wwwtaxndgov. On March 14 2019 the North Dakota Governor signed SB.

This page describes the taxability of. Marketplace facilitators without physical nexus in North Dakota must have. For more information see the North.

North Dakota Supreme Court case. Ad Do you know where you have sales tax obligations. State Sales Tax The North Dakota sales tax rate is 5 for most retail.

One of the more complicated aspects of South Dakota sales tax law is sales tax nexus the determination of whether a particular sale took place within the taxation jurisdiction of South. Most online sellers are by now familiar with the term sales tax nexus as defined in the Quill v. On May 1 2016 South Dakota became the first state to enact pure economic nexus provisions for sales and use tax purposes.

In a direct challenge to the current physical. North Dakotas economic nexus threshold is gross sales into North Dakota exceeding 100000 in the previous or current calendar year. Ad Do you know where you have sales tax obligations.

Economic Nexus And The Future Of Sales Tax Avalara

North Dakota Sales Tax Quick Reference Guide Avalara

Out Of State Sales Tax Compliance Is A New Fact Of Life For Small Businesses

North Dakota Sales Tax Small Business Guide Truic

Economic Nexus And The Future Of Sales Tax Avalara

Business Guide To Sales Tax In North Dakota

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

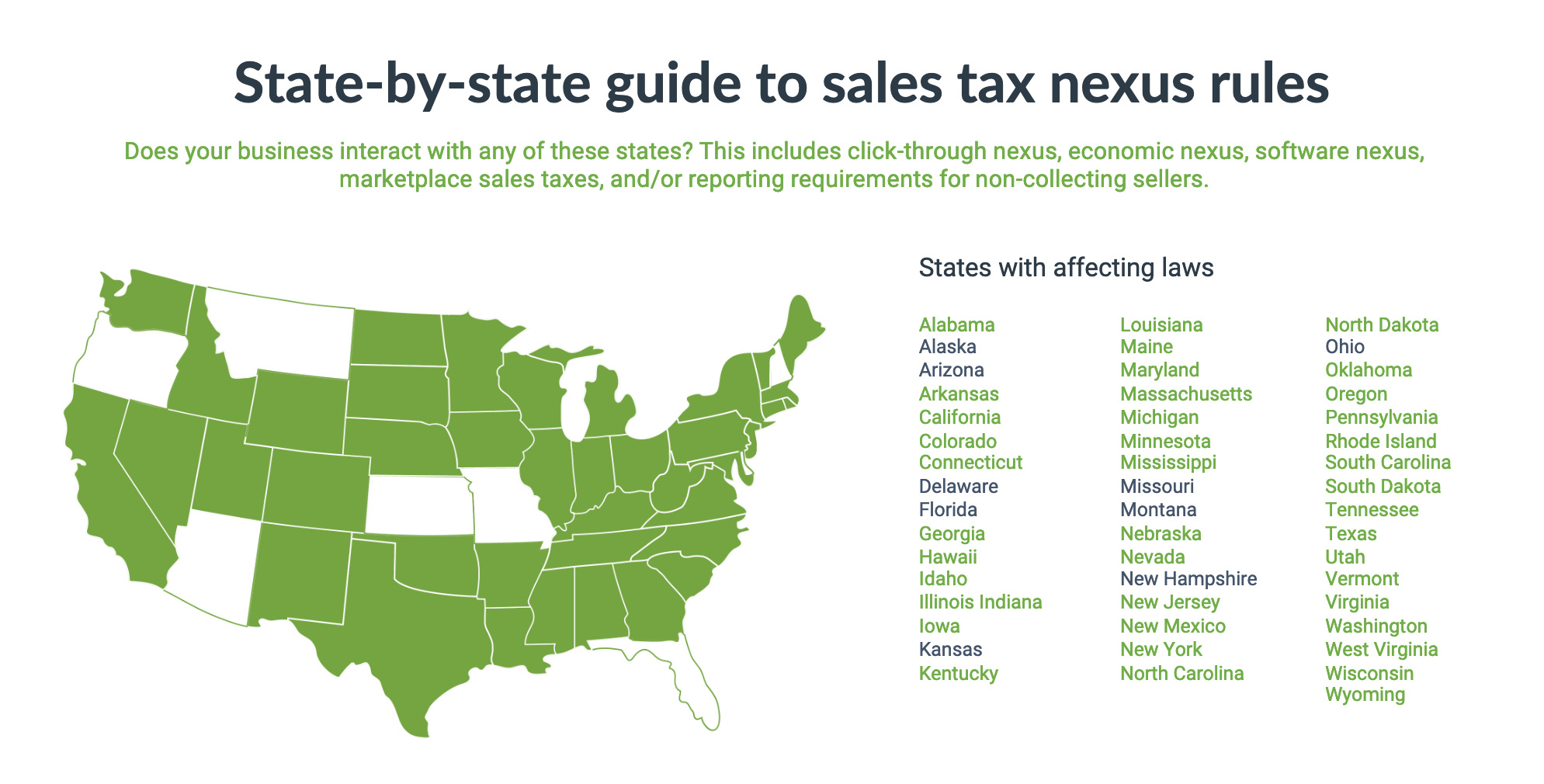

Economic Nexus Laws By State Taxconnex

How To File And Pay Sales Tax In North Dakota Taxvalet

Economic Nexus By State For Sales Tax Ledgergurus

Tax Experts Explain Supreme Court Decision On Nexus

South Dakota V Wayfair How A Supreme Court Case Is Revealing A 26 Year Old Congressional Dormancy Regarding Interstate Online Sales Tax Roosevelt Institute Cornell University

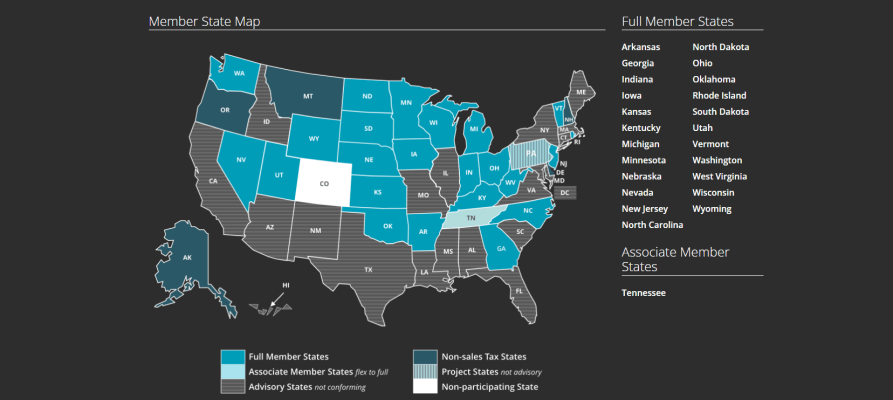

Streamlined Sales Tax Free Online Sales Tax Solution Ledgergurus

Sales Tax Just Got A Lot More Complicated Are You Ready Teampay Teampay

Sales Tax Nexus 5 Signs Your Company May Owe Taxes In Other States Stage 1 Financial

How To Register For A Sales Tax Permit In North Dakota Taxvalet

What Transactions Are Subject To The Sales Tax In North Dakota

Redefining Online Sales Tax South Dakota Vs Wayfair And New Tax Compliance

South Dakota Defeats North Dakota Ends Physical Presence Sales Tax Nexus Debate Carter Shelton Jones Plc